The Trump Card in Play: How Tariffs Are Hitting the Gaming Industry in 2025

By

5 April 2025

The recent implementation of tariffs by President Donald Trump has introduced significant challenges for the gaming industry, affecting both video game and tabletop sectors. These tariffs, part of a broader trade policy aimed at addressing trade imbalances, have led to increased costs, production delays, and potential price hikes for consumers.

Impact on Video Game Consoles

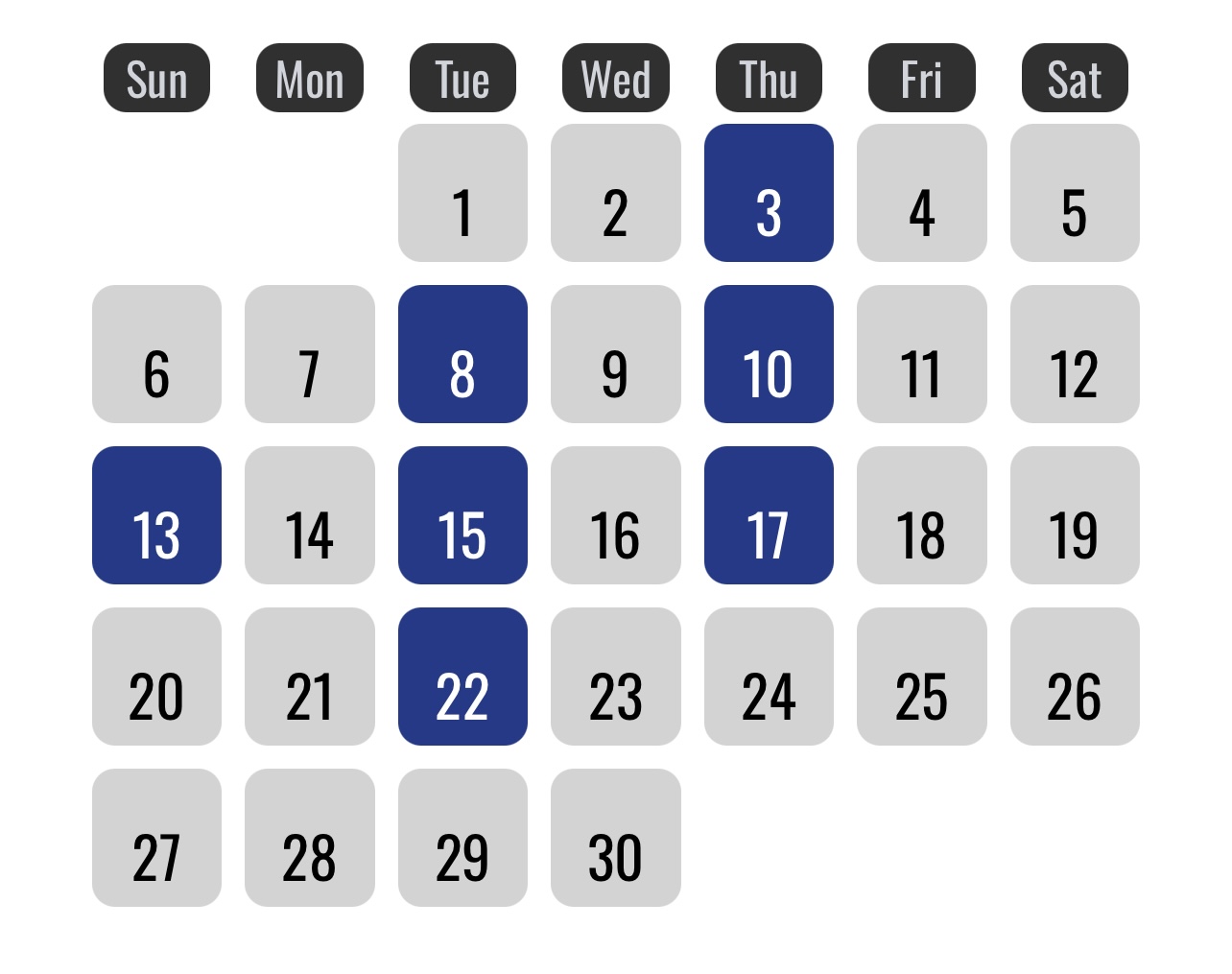

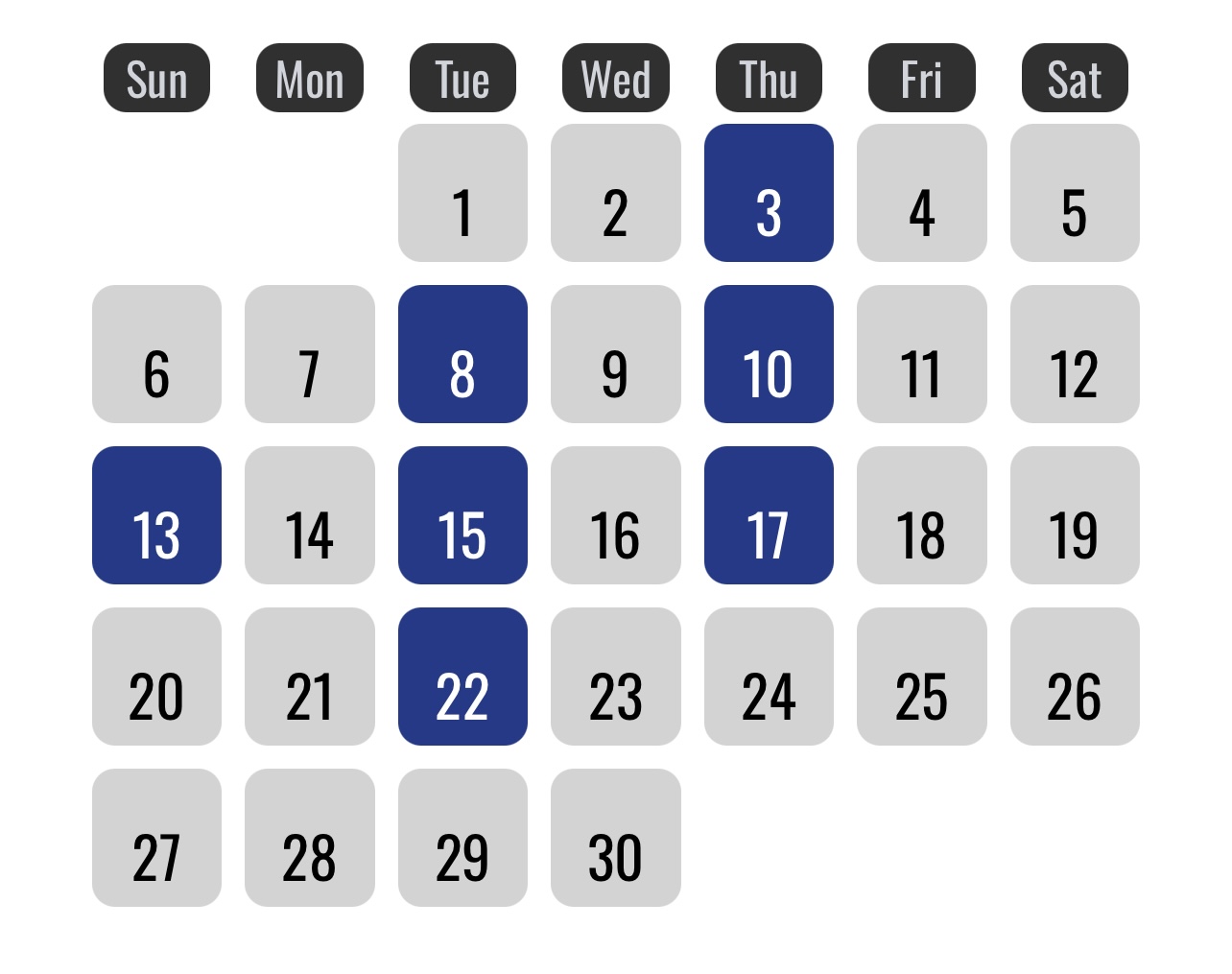

Nintendo's upcoming release of the Switch 2 console exemplifies the immediate effects of these tariffs. Originally set for pre-orders on April 9, 2025, Nintendo delayed this date to assess the impact of the new tariffs on their supply chain and pricing strategies. Despite the postponement of pre-orders, the official launch date remains June 5, 2025.

The tariffs impose a 24% levy on imports from Japan, where Nintendo is headquartered, and a 46% tariff on goods from Vietnam, a key manufacturing hub for the company. These increased costs may force Nintendo to adjust the Switch 2's retail price, originally announced at $449.99. Analysts suggest that the console's price could rise to approximately $670, depending on the final import values and tariff rates.

Nintendo has been proactive in mitigating these impacts by stockpiling units in the U.S. ahead of the tariff implementation. However, the long-term effects on pricing and availability remain uncertain, especially as the tariffs contribute to broader economic instability and market volatility.

Broader Implications for the Video Game Industry

The tariffs extend beyond Nintendo, affecting the entire video game industry, including other console manufacturers and game developers. Companies reliant on international supply chains may face increased production costs, potentially leading to higher retail prices for consoles and games. The Consumer Technology Association predicts that such tariffs could result in price increases of up to 58% for video game consoles, significantly impacting consumer demand and sales.

Impact on the Graphics Card Market

While the broader electronics sector is feeling the squeeze from the new Trump tariffs, the graphics card market is seeing a mixed impact. AI chips and specialized semiconductors—such as those produced by Nvidia for data centers and machine learning—have been notably excluded from the tariff list. This exemption provides a layer of protection for Nvidia’s most profitable segment, insulating the company from immediate financial strain. However, tariffs on other PC components and consumer GPUs imported from China could still lead to price increases for gaming-focused graphics cards. This creates an uneven landscape: Nvidia's enterprise business remains largely untouched, while gamers and PC builders may face higher costs for mid-range and high-end GPUs. Meanwhile, smaller hardware brands without diversified supply chains are likely to feel the pinch more acutely, potentially leading to stock shortages and market consolidation.

Consumer Impact and Economic Considerations

For consumers, these tariffs are likely to lead to noticeable price increases across various gaming products. Beyond gaming, the average U.S. household may see annual expenses rise by approximately $3,800 due to the broader scope of the tariffs, affecting goods ranging from electronics to clothing.

The tariffs also contribute to broader economic concerns, including increased inflation and reduced discretionary spending. As prices for consumer goods rise, households may need to adjust their spending habits, potentially leading to decreased demand in the gaming sector and beyond.

Industry Responses and Future Outlook

In response to these challenges, industry associations and companies are advocating for policy changes and exploring strategies to mitigate the impact. Some are considering shifting production to other countries, though this process is complex and may not offer immediate relief. Others are exploring digital distribution models to reduce reliance on physical products.

The long-term effects of the tariffs on the gaming industry will depend on various factors, including potential policy changes, the duration of the tariffs, and the industry's ability to adapt. Companies may need to innovate and find new ways to manage costs, while consumers may face higher prices in the short term.

Pavithran is a software developer based in Bengaluru, passionate about web development. He’s also an avid reader of SF&F fiction, comics, and graphic novels. Outside of work, he enjoys curating inspirations, engaging in literary discussions and crawling through Reddit for more mods to add in his frequent playthroughs of The Elder Scrolls V: Skyrim.

EXPLORE